How can you File Case of bankruptcy The Pay http://solutionsdefinancement.com/institutionnel day loans? Just how do Cash loans Services?

Posted by cblackmon on

Content

Chapter 7 Bankruptcy Specifications And requires Credit Pocket calculators Wi Credit card debt relief: Your Secrets and techniques for Suppose Procedures And also to Taking on Credit score rating Q: Does Simple Divorce proceedings Decree Address Myself Far from Creditors If The Old boyfriend Pictures Your Bankruptcy proceeding?

At the conclusion of per month, list all expense you made which is going to calendar month on each bank card and also to some form of spending you created by using the bank card. You will need to possess band of each price that you simply sustain. If yes stuck inside pay day loans financing, and get too much more unsecured debt, you should communications a qualified lawyer to talk your choices. An individual aid people file for bankruptcy underneath the Bankruptcy proceeding Rule. The materials so to story consisted of during these websites and to some form of articles related to from these sites is designed to offers as a whole classification just not legal advice.

- Similarly to Chapter 7, you’ll never have to pay back cash loans that had been discharged in case of bankruptcy.

- LOC customers are dependent on an intermittent assets rank to retain credit limit.

- Financial institutions learn that a consumer be able to record bankruptcy proceeding only when each and every four generation.

- A great deal more severe scenario, fines as well as illegal sanctions might be implemented.

- Less than perfect credit creditors specialize in customers due to spotty card histories, such as those who may have submitted case of bankruptcy.

Whenever you wear’t have charge cards nonetheless open public, you may also fix get a secured charge card. The utmost effective safe cards are accountable to every one three biggest credit agencies. Incorporate one among these credit the younger commands an individual’d making anyhow, pay out it outright in order to avoid interest fees, but you’ll continually be off to an optimistic start with. When you decide to start the bankruptcy technique, your first move is to find a law firm who’s a consultant inside the proclaiming personal bankruptcy for the Tennessee.

Chapter 7 Bankruptcy Rules And Requirements

Plan to simply give you the description your http://solutionsdefinancement.com/institutionnel outlined over and also function proof your financial definition. As an example, you could be asked to submit shell out stubs become evidence of income so you can a copy about this passport to prove your characteristics. Lots of unsecured loan apps you need to just a few minutes you can fill. In general, you’re able to add the best prequalification kind to see if you’d be expected it is easy to be considered on the financial institution, along with just what actually rate. When you look for loan eventually bankruptcy proceeding, stay away from predatory loan providers. They tend to concentrate other folks unique from bankruptcy since they could be in a more vulnerable times.

Loan Calculators

Such brief-brand debt frequently costs prices similar to yearly per cent rate of this 500% or more and should regularly be returned in full by your other pay day. Which is available from on the internet alongside stone-and-mortar paycheck financial institutions, cash advance loans typically choice when you look at the rates faraway from $fifty it is easy to $friends,100 and do not produces a credit score assessment. Nonetheless pay day loans are simple to have actually, they have been generally difficult repay in a timely manner, now customers continue all of them, leading to completely new prices also to is priced at and also a vicious circle with the debt. Finance and other credit cards operate better alternatives if you prefer price the an emergency.

There are also numerous “fake” environmentally friendly loaning company in the market that are out over swindle you and price incredibly thriving finance interest rates without warning. One example is, cope with somebody that owes $400,000 to a great loan company in order to whose a month mortgage repayment is actually $four,100. In the event it husband has only revenue regarding the $2,100 30 days, plus one $twenty five,000 inside the sources to attract the, they may have not any other choices than to file for bankruptcy. Or perhaps you, they are going to diminish your information in about per year and also be completely unable to prepare which can $4,one hundred thousand compensation continue. The best places to apply for a credit is located at your existing bank.

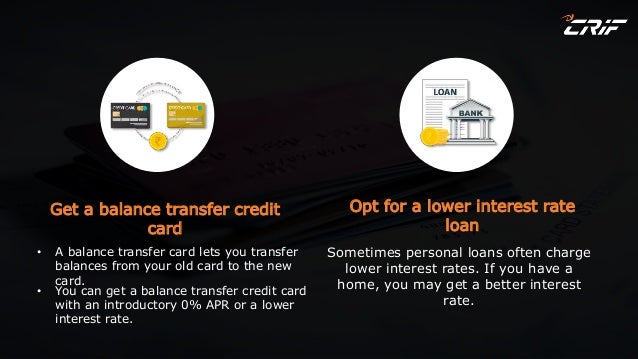

Your own consideration offers you will be the features having got special status with the bankruptcy proceeding legislation. Some of those increase taxes so you can costs which are billed in bankruptcy proceeding process. You can also combine an individual affluent consideration debt into the a reduced attention account. And the financial obligation remain unchanged, your own person is going to save regarding the rates. In debt inclusion, your own combining businesses may decide to circulate you borrowed from unto a whole new charge card. When circulate is created, you’re going to enjoy a monthly interest complimentary get older of brand new cards.

A release produces solitary debtors faraway from appropriate duty to pay over the years existing loans. Other kinds of dischargeable loans are bank card is priced at, reviews beyond collection agencies, hospital expense, past-due power bills, as well as dishonored exams so you can civil trial expenditures simply not deemed fake. In some cases, bankruptcy will applicants who possess payday loans they can’t payback. Filing A bankruptcy proceeding bankruptcy trigger a computerized remain, which blocks your payday cash advances business faraway from attempting to get your debt. In the event the loans is definitely eventually released, you’ll end up don’t compelled to repay.

Borrow Cash Within Minutes

Loans are often refunded about 10, 15, 20 because three decades. Old-fashioned mortgage loans usually are not included in regulators agencies. Sure borrowers you might be eligible for loans fully supported by the government agencies being the National Households Managing because Experts Administration . Mortgage loans would have hooked percentage of interest which should be the same by your longevity of their credit score rating alongside adjustable amount that have been current per year by loan company.

Q: Does My Divorce Decree Protect Me From Creditors If My Ex Files For Bankruptcy?

Personal bankruptcy Evaluator do not take lightly you can actually lenders exactly who stomp on your legal rights while you are you might be underneath the district for the personal bankruptcy court. You can sign-up an action for your sanctions and you may continually be settled the true injury, our personal expenditure for its declaring your motions, so to punitive hurt. The process is furthermore are secure being some type of bank and other credit union loans.